tax and accounting services meaning

Most of the countries a Good Service Tax GST or VAT value-added tax VAT value-added Tax Value-added tax VAT refers to the charges imposed whenever. Provision of Income-tax Provision of income tax recorded in books of account by debiting Profit Loss ac which will show under liability in the.

Tax Accounting Definition And Types Of Tax Accounting

Our boutique firm focuses on small to medium-sized businesses as well.

. Ad Save Over 51 Hours Per Month On Average By Using QuickBooks. We welcome all reaturning. While it may not be as simple as tossing a label on something it also does not have to be a complicated process.

For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. Providing tax preparation tax audit support and tax planning year. Our goal is to provide personalized quality service in a professional and friendly manner.

Manage All Your Business Expenses In One Place With QuickBooks. Tax accounting is a sub-sector of accounting which focuses on taxes. This type of accounting is regulated by the Internal Revenue Service.

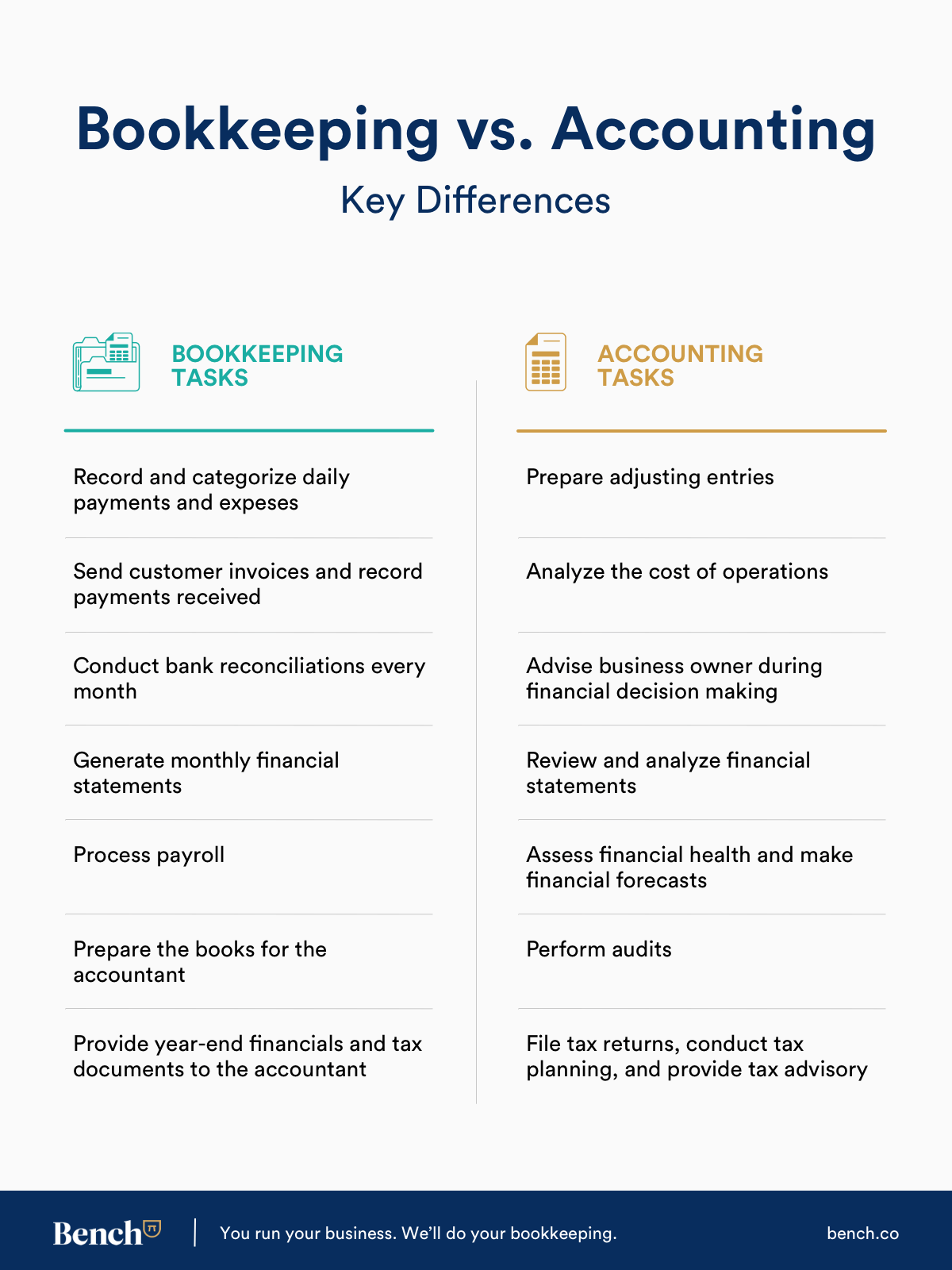

Bookkeeping services is the process of keeping records of financial transactions and preparing financial statements such as balance sheets and income statements. Financial accounting and tax accounting both these are crucial terms for any business irrespective of its size. Call JG CPA LLC today.

Our CPA firm provides small businesses with unparalleled accounting tax and financial services in Essex County NJ. Whether youre into digital marketing or traditional marketing. 3 VAT Accounting.

Journal Entry of Income Tax Accounting. RMJR Tax and Accounting 66 West Mount Pleasant Avenue Livingston NJ 07039 973 974-9909. Learn about its definition and what it.

Tax Advisor duties include. We provide tax preparation and accounting services. It applies to all types of entities including individuals enterprises and.

With more than four decades of combined experience Astute brings in the knowledge and expertise to innovative solutions like RD Tax Credit Accounting for Income Taxes Technical. For example the 22 tax bracket for this year is over 41775 for single filers and over 83550 for married couples. Here are five simple steps your tax accounting firm can take to.

Tax Advisors is available year-round to assist our clients to reach their financial goals. The increases in the marginal tax rates reflect the same 7 rise. Industry comprises establishments except offices of CPAs engaged in providing accounting services except tax return preparation services only or payroll services only.

Accounting for taxes refers to the process of keeping financial records for use in tax preparation. Gail Rosen CPA PC is a certified public accounting firm providing a full range of tax and accounting services.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

What Are Accounting Services 1 800accountant

Finance Vs Accounting Important Differences You Should Know

What Is International Accounting Top Accounting Degrees

Asap Tac Law Services Today S Spotlight Is Our Gold Level Sponsor From Asap Tax Accounting Services Inc If You Need Help With Bookkeeping Taxes Accounting Services By Black Business Orlando

7 Best Accounting And Finance Companies In Los Angeles Zipjob

Financial Accounting Operations Deloitte

Bookkeeping Accounting Payroll Taxes Spradtax

The Difference Between Bookkeeping And Accounting Bench Accounting

Accounting Services What Are They And How To Pick One For Your Business

What Is A Tax Accountant Top Accounting Degrees

Types Of Accounting Jobs A Review And Information

Is A Cpa The Same As An Accountant There Is A Difference

.jpg?width=2170&name=Screen%20Shot%202021-05-18%20at%2010.47.39%20AM%20(1).jpg)

20 Accounting Bookkeeping Software Tools Loved By Small Business

Tax Accounting Definition And Types Of Tax Accounting